Let's talk turkey about Minneapolis real estate developers Drew Levin and Danny Perkins. Levin and Perkins acquired the nickname the "Turkey Guys"after their successful restaurant and catering business, Turkey to Go. They have gained national fame and adulation as the stars of the HGTV reality series, "Renovate to Rent." They are major investment property owners in the city of Minneapolis.

|

| Turkeys overrunning a neighborhood. |

Levin and Perkins have taken out a total of $5,692,000 in loans for their Wedge properties. From public records, it's impossible to say how much of the debt has been paid off, how much is secondary financing, and how much of the bundled mortgages relate to Wedge properties. Steven Kalin is their most frequent lender, but they have also received substantial financial banking from these community banks: Merchants Bank, Anchor Bank, and Western Bank. They have also been bankrolled by regional Bremer Bank and Wells Fargo, a large national bank. Anchor Bank is their primary Wedge financial backer, lending them $2,651,500. (It would be interesting to find how much Anchor has loaned to individuals for home mortgages in the Wedge.)

KLP's (Levin and Perkins) first acquisition in the Wedge was 2613 Bryant Ave. S., purchased from Moneyapolis, LLC, for $215,000 in September 2008. This was the month that saw the collapse of Lehman Brothers, a sprawling global bank, a collapse which almost brought down the world’s financial system. The industry was saved by huge taxpayer-financed bailouts. But now chary of lending to individual home buyers, the "too-big-to-fail" banks have turned their corporate eyes to greener pastures, namely investment in real estate development.

|

| 2613 Bryant Avenue South |

1.2 million people lost their homes through foreclosure during the 2008-2009 banking crisis. Investors quickly jumped on the opportunity to leverage a fortune out of the misfortune of others by buying up these properties As indeed they brag on the HGTV website, starting in 2008, Levin and Perkins went out in search of foreclosed properties. A big bank is listed as the owner of four of the properties they bought in the Wedge: 2113 Bryant (Wells Fargo), 2612 Colfax (Capitol One), 2621 Colfax (US Bank), and 2814 Colfax (Bank of America). For another five properties the seller is listed as an LLC (Moneyapolis, Simple Living, Properties Ideal, Shree Investments, and TDL Properties).

No clear profile emerges of KLP when you look at public information associated with their properties: the addresses, buyers, sellers, loan amounts, and lenders. The list is filled with LLCs. Some properties have a series of five mortgages associated with them. Entities buy and sell the properties, passing them around, appearing at one address as a buyer, another as a seller. This befogged tangle of names and numbers is impossible to penetrate.

The enormous number of properties that changed hands during the 2008-2009 financial crisis has created a nightmare for title companies that continues to this day. When a property is sold, title companies often have to sort through a list of owners, loans and liens, to determine if the property can be sold with clear title. This title mess creates more obfuscation of who's buying, who's selling, and who's financing a given property. It contributes to the confusing blizzard of data found in public records related to investment real estate.

|

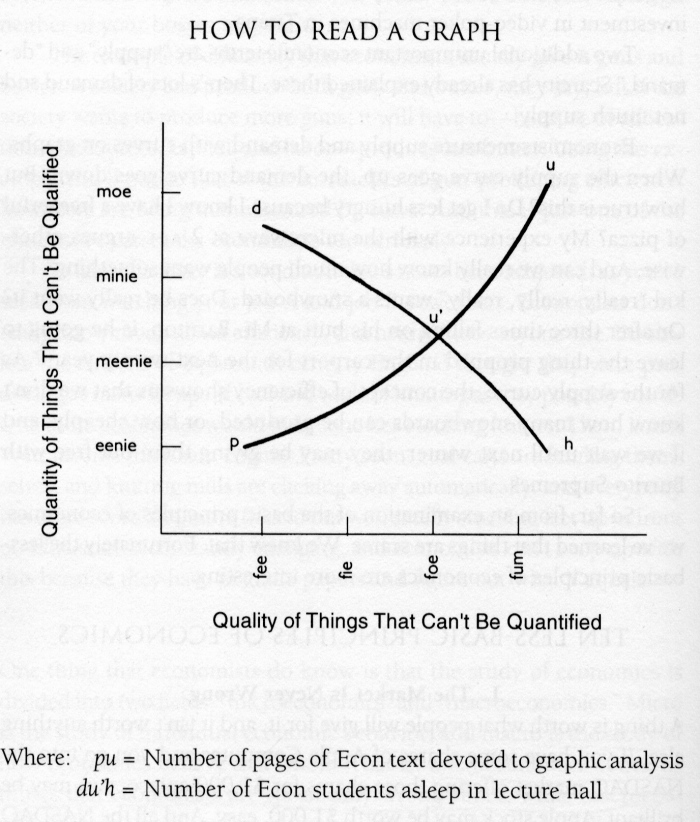

| Graphic courtesy History of Economics Playground: Capitalism |

In the 1960s much of the Wedge was absentee-owned. The 1963 upzoning brought dramatic changes. On just about every block, houses were wrecked for walkup apartment buildings. Absentee-owned houses became crash pads. One evening, an old couple, watching from the house they had occupied for 50 years, counted 400 revelers pouring in and out of the house next door. A drugged-up young man sprayed his neighbor's house with automatic weapon fire. A guy on LSD leaped from his apartment into the second-story window where a child was sleeping next door. Tenants rode motorcycles up the staircases of houses.

Thankfully, those awful days are long gone. Run-down houses were bought by homeowners who rehabbed or restored them. Condemned apartment buildings were made into Section 8 (low income) housing. Homeowners and renters banded together to stop crime, monitor absentee properties, and generally improve the quality of life in the neighborhood. The Wedge was eclectic, funky, economically diverse, with affordable rents in a wide range of building types. Some have called this process of cleanup and rehab "gentrification", and in some ways, it was. However, it was nothing compared to the process of upscaling and gentrification under way right now.

|

| A one-bedroom apartment in this older building on 26th and Bryant rents for $695. |

These new apartments are "market rate" (what the market will bear), not by any stretch of the imagination "affordable." As more new apartments come on line city-wide, rents have increased by an average of 4.8 percent to $1,098 per month in 2015. Compare this average figure to rents in new Wedge apartments, for example, $1,795-$2,745 a month for a two-bedroom (877-1161 sq. ft.) in Flux Apartments on the Greenway, or $1,745 monthly for a two-bedroom unit (683 sq.ft.) in Motiv Apartments on 24th and Colfax. Thanks to these new apartments, in the Wedge the percentage of rent increase is likely higher than the city average.

| One-bedroom apartments in this new Wedge apartment building rent for between $1539 and $2445 monthly |

The duplexes next to my house and across the street were owner-occupied for decades. No longer. Turning family homes into rentals and new infill development raises rents and the value of the property as land (i.e., building sites), but lowers the value and attractiveness of older houses nearby. I've heard comments from two owners who sold their beautifully restored single-family houses and moved out of the Wedge that they saw "the handwriting on the wall." Not wanting to deal with increased congestion, construction chaos, and more absentee-owned buildings on the street, they felt they were gettin' out while the gettin' was good.

Increasing absentee-owned rental units in a neighborhood undermines a sense of community. Many renters are just passing through. The 2013 figures show that in that year, 35% of Wedge residents had lived there less than one year. It's hard to build relationships with your neighbors when they change so frequently. Knowing your neighbors is the key to community pride, including crime prevention and a sense of civic investment.

To return to where we started: It's very difficult to parse what all the figures and data about KLP's real estate investments mean. Just looking at all the loans, the addresses, the numerous banks, LLCs and private financial backers for KLP is enough to give anyone a migraine. It's a murky swamp of data that's impossible to see into. Economics is not an exact science, and there are many conflicting points of view. And certainly, one hesitates to accept the word of City officials who clearly are supporting their agenda. If residents protest, they are tarred with the NIMBY brush. The attitude of the City is: "This is going into your back yard, whatever argument you make. Whatever you say, we won't listen. If you don't like it, leave."

So, what can we see beyond the smoke and mirrors, political rhetoric and bureaucratic gobbledygook? One thing is as clear as the handwriting those fleeing the neighborhood saw on the proverbial wall: The Wedge has been targeted as a haven for investors, a place where owner-occupants are a rapidly dwindling demographic. Whether or not this is seen a good thing depends on whether you are an investor or resident, I suppose. It remains to be seen if these changes will make the interior of the Wedge more or less attractive to prospective tenants as well. From what I hear from my renter neighbors, they find the old, funky Wedge a great place to live.

| |

| On 28th Street, old and new buildings of compatible scale and design. |

|

| Around the corner, KLP's "sore thumb" infill (center) of incompatible scale and design. |

One day, sooner or later, this latest apartment building boom will cease. By the time that happens, will the Wedge still be the Wedge or will it be just another nondescript absentee-owned real estate investment farm?

| What is that thing blocking out the sun? It's the latest infill multi-unit apartment building! It's HUGE! |

No comments:

Post a Comment